China continues to provide global ecommerce leaders with case studies and emerging best practices about how to connect with consumers during and after the COVID-19 crisis. As the first country to push beyond the depths of the crisis and re-open for business post-quarantine, China offers luxury brands insight for how they can help offset stalled sales in other global markets in the thick of the fight against COVID-19 reports Jing Daily.

The Jing Daily team spoke the head of ten different China teams of major luxury houses and highlighted insights from Louis Vuitton, Calvin Klein, Lanvin, Burberry and Prada.

WeChat Platform Offers Store Associates a Way to Connect

U.S. retailers have been laying off legions of retail store associates; many of these associates have relationships with loyal customers that frequent the store. These loyal shoppers that are likely online now given all the store closures.

Some far-sighted U.S. retail leaders see the opportunity to stay connected with their loyal shoppers and are calling them just to check in on their health and well-being. Not to sell – just to stay connected and point them to services if needed.

In China, Jing Daily reports that the quarantine forced brands to quikcly turn to e-commerce and social channels including WeChat pop-up shops. Store-based retail sales associates became super-KOLs (key opinion leaders) for brands, which opened a personal one-to-one connection to communicate with fans of luxury brands.

Louis Vuitton leveraged its fully-functioning omnichannel platform and asked sales associates to forward QR codes enabling their clients in China to use WeChat. Louis Vuitton also produced the first “show re-see” via WeChat, featuring actors showcasing their favorite items. These products became bestsellers. Another benefit was that the WeChat strategy helped the brand acquire new customers since WeChat users were offered an exclusive view of spring and summer products available to purchase. A side benefit for Louis Vitton was that its team acquired WeChat account and phone numbers (as well as other customer info), allowing them to stay in touch and nurture the new connection into a longer-term relationship.

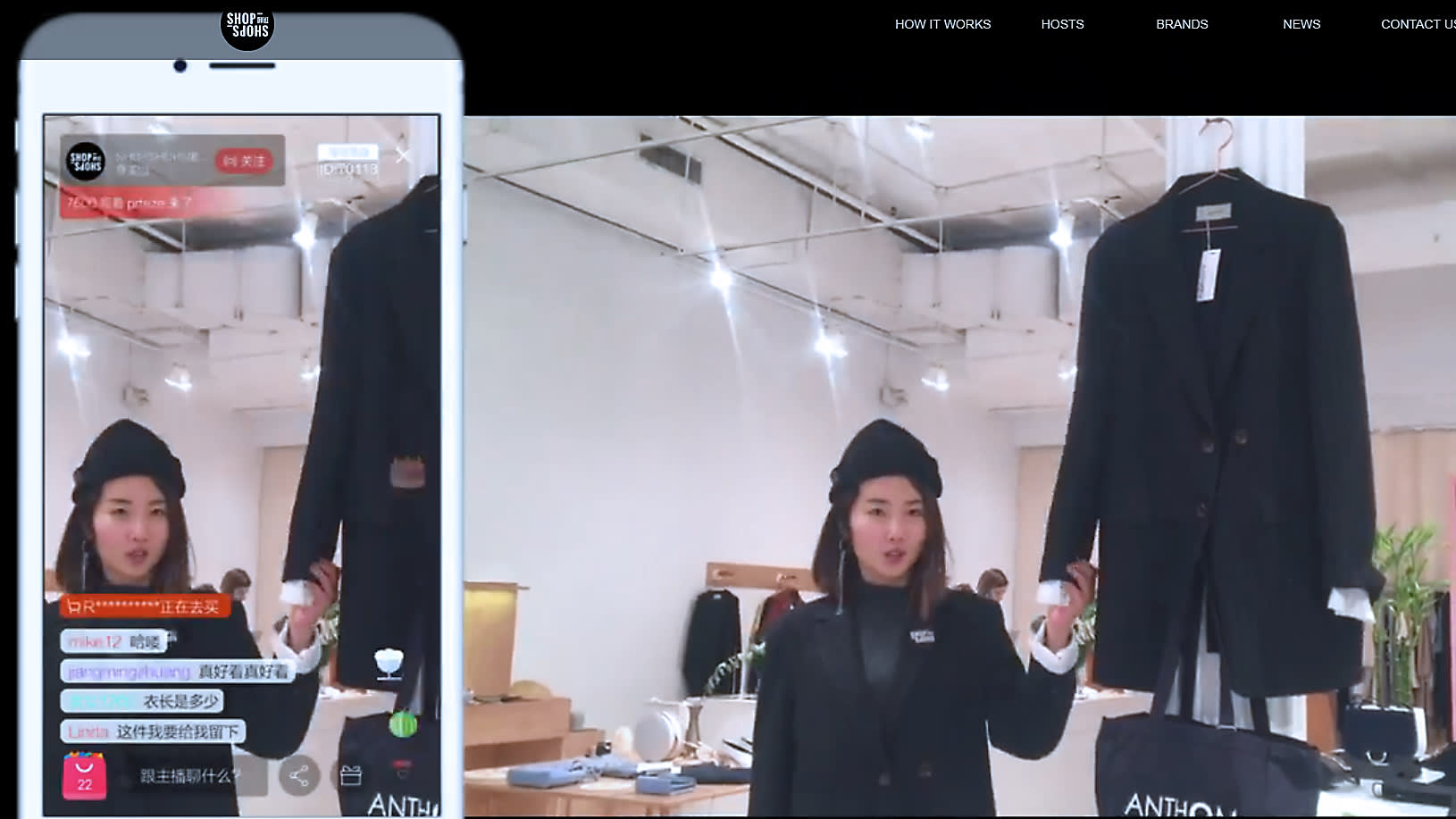

Livestreaming Utilizes Shuttered Stores to Showcase Goods

Leaders in China like Burberry used livestreaming on Alibaba’s Tmall to replicate the in-store experience and highlight luxury products sitting on store shelves waiting for a new home.

The article details how British luxury brand Burberry invited KOL Yvonne Ching to visit its Jing’an store in Shanghai and livestream her experience on Tmall. Jing Daily reports that the session garnered over 1.4 million views, and within the hour, most of its featured products sold out.

“We have seen a clear shift in customer behaviors in China over the past couple of months, and we are delighted that we could connect with so many customers during the Burberry livestreaming on Tmall,” said Josie Zhang, President of Burberry China, in her introduction.

Icicle, a Shanghai-based luxury brand, launched livestreams across multiple platforms including its official brand channels on TikTok to sales associates at specific stores. The Jing Daily researchers touch on how Icicle is innovation to elevate its brand image through livestreaming-based styling and storytelling content. So far initial efforts from its official brand livestream sessions have garnered about $70,517 (500,000 RBM) on average; a valuable new revenue stream given the retail collapse in China and the rest of the world.

Virtual Reality Provides Home-bound Shoppers in China Immersive and Entertaining Escapes

Virtual reality (VR) is another innovation connecting retail brands with their quarantined shoppers. Lanvin experimented with VR to let its audience experience a rare front-row view of a cloud fashion show produced during Paris Fashion Week in partnership with video platforms Douyin, Yizhibo, iQiyi, and the luxury e-tailer Secoo.

Jing Daily detailes how the brand worked with fashion bloggers who livestreamed behind-the-scenes action from the show. The program generated over 5 million views; the iQiyi show itself had 585,723 views. The brand also built a VR flagship store where customers could shop virtually at a flagship store in Shanghai by instantly connecting with sales associates on WeChat.

Other brands in China also used cloud-based pop-up stores to entertain and engage staying-at-home shoppers. Calvin Klein connected by syaing “We are not asking you to go out, but we’re not asking you to be bored!” Klein’s campaign centered more on entertainment than direct selling; featuring Chinese rapper Xiao Gui and letting viewers journey through a maze to browse assorted product lines and engage in contests and promotions.

Innovation Has Legs

Great job by the Jing Daily team and by the brands they interviewed. Leaders lead in the most-challenging of times and these brands are showing the way forward. These innovative practices will likely have long legs and global ecommerce leaders should be making plans for a long recovery where the roles of stores may be forever altered. This is especially true for luxury brands which will likely face strong headwinds in the months ahead (if not years ahead).

The article concludes that COVID-19 has disrupted the traditional playbook for communicating certain brand values. Global retail and ecommerce leaders must innovate to connect with consumers. They need to rethink how their sales associates and digital teams can work together to use technologies like messenging and specialty platforms, livestreaming, VR, or other social media tools to connect with shoppers in China and throughout the world.

GELF’s coverage of the innovative ways that brands in China are leveraging digital commerce to re-emerge will continue. Please let us know what is working for you as you connect with shoppers locally and globally.

And join the GELF community at GELF’s new podcast …

Stay healthy and stay in touch!