If you think one strategy for ecommerce expansion into APAC will be successful, get ready to learn some tough lessons. Larry Luk, head of e-commerce for Calvin Klein’s Asia Pacific region joined GELF’s long-time friend Marcelo Wesseler on stage last month at Shop.org’s Digital Summit to discuss market entry strategies in Asia Pacific. Marcelo is the CEO of SP Commerce, which emerged last year as Trade Global, Jagged Peak and Singapore Post joined forces.

Luk cut to the chase as to why companies need a country-by-country focus to drive their planning. “When we talk about Asia, the perception is that it’s one country, but it’s really not,” Luk said.

In more mature countries like South Korea and Japan, ecommerce’s share of retail is in the low-to-mid teens market. But in other countries it is much lower (APAC wide average is 12.4%).

What were the five key take-aways?

Marcelo introduced some key market stats that helped set the stage so to speak. As you can see below, the US trails different countries in APAC in several key digital maturity indicators. Again, entering different countries requires different strategies – in APAC and elsewhere.

1. Test the waters before you jump.

Test and learn. Repeat. In the GELF market entry framework, we highlight the importance of starting with international shipping as companies test and learn which products and ecommerce practice and policies are attractive to online shoppers in different markets.

Get local partners involved and listen to what they can share what local, in-market preferences. Don’t be afraid to fail fast.

2. Carefully select markets and platform.

Consider India vs Australia. As highlighted below, de minimis levels (e.g., the duty free threshold), payment preferences, average order size and of course the volume of shoppers are all distinct from market to market.

3. Know the regulatory & product restrictions

Larry and Marcelo spent a good bit of time talking about the importance of navigating the regulatory differences throughout APAC’s respective markets.

As noted by Chelsea Reay in this nice recap, retailers looking to expand internationally need to watch average order size dynamics because it can highlight thresholds for when they need to consider building more of an in-country presence – or potentially explore omnichannel fulfillment with in-country assets.

“Look at average basket and product pricing,” Luk reminded retailers. As the chart above highlights, de minimis levels vary significantly throughout Asia and can heavily impact profitable international expansion.

4. Evaluate inventory and fulfillment strategies

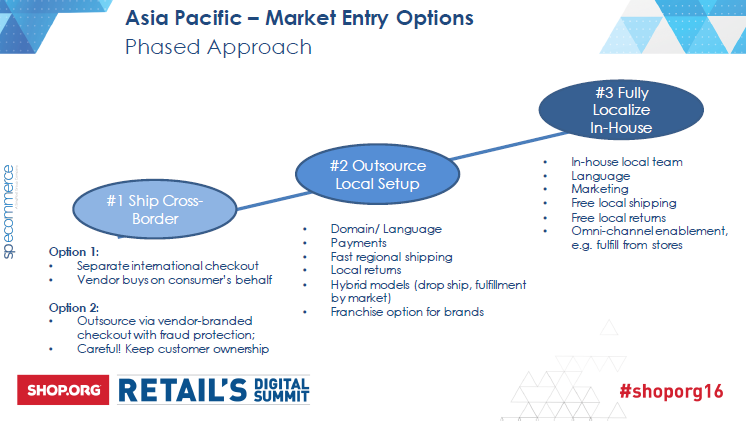

Here is how SP Ecommerce sees the stages of international expansion. As companies test and learn, as average order sizes increase and as they learn more about the partner ecosystems in each country, we see that different inventory and fulfillment strategies become more relevant.

5. Marketing will be your biggest challenge

At GELF NYC ’17 we will continue to explore how leading retailers expanding internationally are overcoming marketing challenges. Increasingly we see leaders that localize the experience for their cross-border shoppers have more opportunities to connect with new shoppers.

Too often the importance of investing in international customer acquisition is overlooked by online retailers. As we have discussed since 2014 at our first GELF NYC, digital marketing and traditional media strategies are both crucial for brands that want to connect and engage with new cross-border shoppers.

Great job guys!

Look forward to having you join us at GELF NYC on Feb 9th at GELF’s new home at Convene – 117 W 46th Street near Times Square.

Until next time!